If you’ve been in Sales or business for a minute – you’ve heard of categorizing your leads.

The good ol’ are they HOT, WARM or COLD?

This is definitely useful.

But if you’re a top sales-professional, or want to take your income to the next level – you have to take your processes to the next level too.

You can’t expect to use old methodologies to produce new results.

In other words, improve the way you categorize & process your financial leads also!

If you purchase financial leads or market your business to generate leads,

have effective ways of sifting & sorting (or you will be throwing money away).

Not all people that filled out a form online or attended a free seminar are ready to buy today or ever.

So instead of spinning your wheels, beating yourself up or treating them all like buyers, identify the stage they’re in.

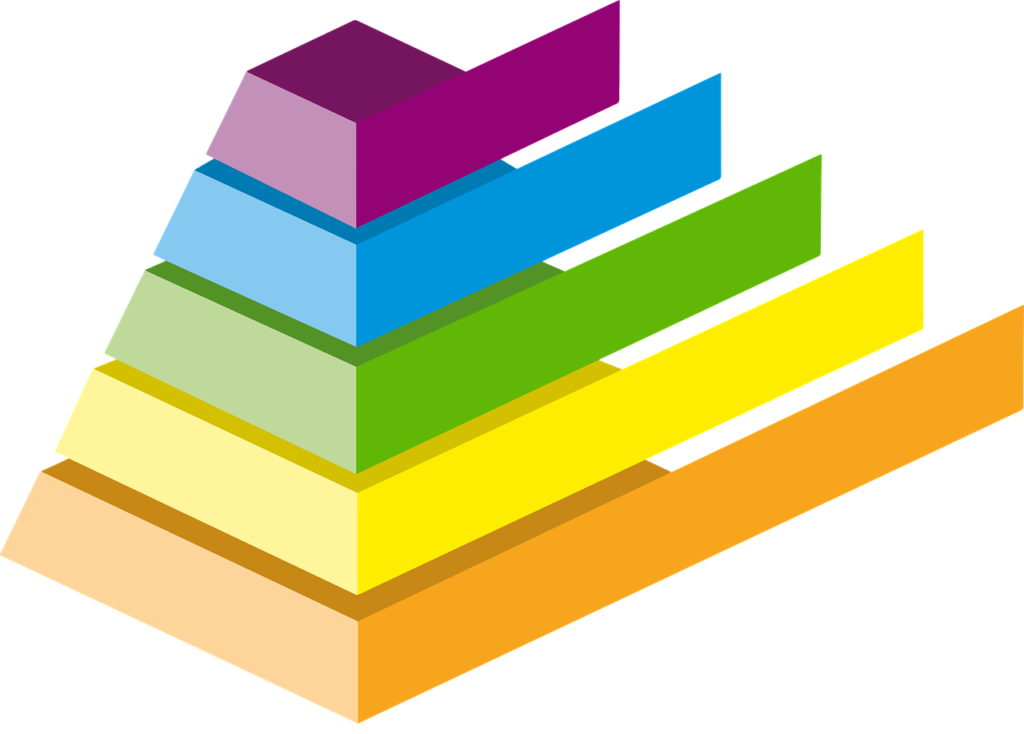

Next-Level Lead Categorizing

Working with Financial Advisors in different markets & from different FMOs – we know that how you follow up will vary based on how the lead ‘came in’.

However, one thing we see consistently is that there are generally 3-4 types of people coming through marketing funnels.

Leads Financial Advisors Purchase:

- Time Wasters – people bored, curious or scrolling social media

- Leads – valid contact information (have a problem, but not in pain)

- Prospects – have assets/resources, know they have a problem & want a solution

- Buyers – have resources, know they have a problem & are actively looking for help

So let’s take a closer look at these next-level categories.

As a solo financial advisor or small business owner, you should NOT be chasing or investing much on Time Wasters.

Hence the title. 😉

These are names & contact info you bought.

People that may have a problem, but aren’t in pain yet.

They’re early in their buying process (and not ready to buy).

Or might not even be ‘qualified‘.

Time Wasters will either provide a false email address, no phone number or will BLOCK your number.

Leads, while they may provide correct contact info (because they really want the FREE book, information, content). They are people that may have a problem, but are not in pain (ready to take action).

As a Financial advisor you should not bother with Time Wasters or Leads (unless you have zero prospects & your pipeline is dry).

If you have an assistant or a way to automate this type of follow up – USE it!

If not, outsource this work.

Have your system deliver you people that DO want help & DO want to speak with you.

Prospects are different – Treat them different

Now that we’ve gotten that group out of the way, let’s talk about the ones you should be spending time with.

Prospects.

They are at a different part of the buying process.

These are people that know they have a problem & want a solution.

They are doing their research online (and collecting information to make a decision).

You want to be investing time or resources in these.

(But still do NOT chase – you don’t want to ‘turn them off‘ from working with you).

- Have conversations with prospects.

- Understand their time-frame.

- Show them why you.

- Provide them value.

- Follow-up properly.

Converting leads into prospects & prospects into clients is part art & part science. Make sure you have the right tools in your tool belt & processes in place.

Choose Buyers Over prospects

In theory, all leads have the potential to become prospects or buyers.

But as an advisor with finite time & resources, you should maximize your super power.

When choosing between leads, prospects or buyers; always spend your time with the buyer (and make sure to have a follow-up process for the prospects or leads). 🙂

Buyers have done their research and have decided they are ready to DO something.

They are just looking for the right partner/product.

This should be you!

Once you have identified you have a Buyer on your hands, don’t let them slip through the cracks.

Have an effective and repeatable process to convert them into clients.

In summary…

Know the difference between leads, prospects & buyers. Then treat them accordingly!

Correctly Categorizing & Prioritizing follow-up:

- saves you time, money & mental capital

- minimizes you stressing & guessing

- stops you from chasing the wrong leads

Thinking they’re prospects…

Or worse, invest precious resources on TIME WASTERS – rather than on prospects & buyers.

As a business owner/sales professional/financial advisor, you have more important matters to tend.

Your time is best spent where you get the greatest return; doing work only YOU can do (that nets the greatest profit).

Anything else will leave you depleted, deficient or deflated.

Find a system that works and execute it (or get help doing it).

It doesn’t have to be complicated, it just has to be effective!