As prices and expenses keep rising more people & businesses are looking for ways to cut costs while sustaining or increasing revenue.

How can this be done without breaking the bank?

This depends on the people & the business.

The following short list is what we’ve seen our Financial Advisor clients do when things are good & especially when times are tougher.

If you’re looking for ways to keep growing your practice during a recession, without spending a fortune – keep reading!

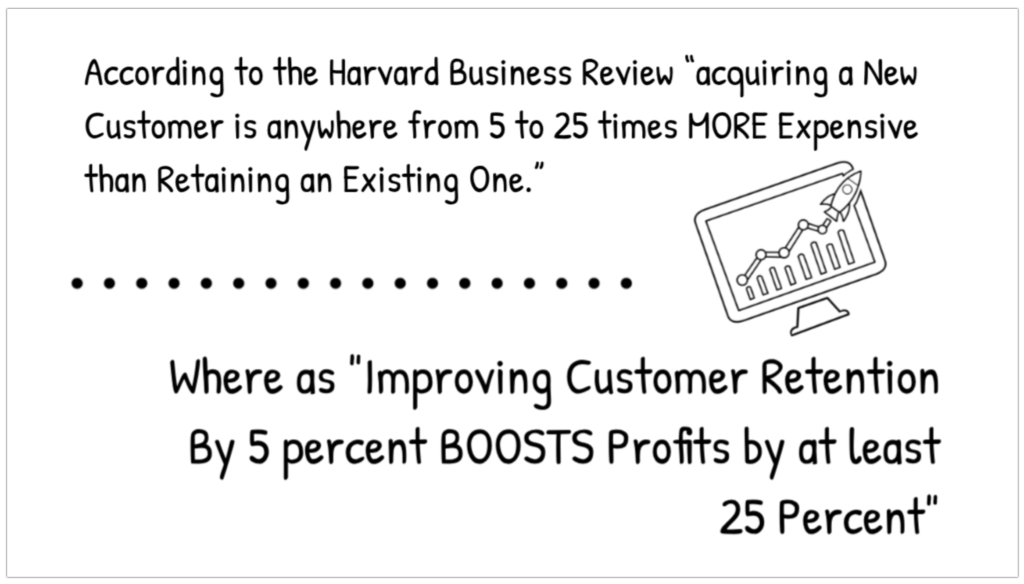

Retention

This may or may not be news to you.

But keeping clients that have already said yes to you and have chosen you as their Financial Advisor, doesn’t just feel good – it’s good for business!

Host educational events – that provide value to your existing clients in an area they may need help in or that are seasonal/topical.

Topics you can turn into Events:

- College Funding

- Estate Planning

- Tax Savings

- Medicare

You don’t have to spend a fortune to grow your practice & keep your clients happy.

You just have to be consistent.

Referrals

“81% of consumers trust the advice of friends and family over professional business advice.”

When talking to Financial clients; find out if they have family or friends you can help.

Encourage them to invite guests to your educational events.

Adult children get married, their needs change.

Co-workers have similar situations & issues as your clients.

Help them too!

💡 Another way to get referrals is by tapping into Networks where your prospective Clients are.

Connect with other professionals or social groups that also service your clients (Estate Planning Attorneys, CPAs, etc.).

Financial advisors utilizing the above strategies are not dependent on any one IMO or FMO to provide leads, nor are they dependent on the ‘perfect’ situation.

They are forging their future & determining how they succeed.

Be that guy or gal! 😉

Reviews

When COVID19 hit and businesses were literally shut down, we saw some of our Financial advisors not even miss a beat in their business.

Specifically the ones doing Annual Reviews with clients.

They kept humming right along without having to ‘pivot’ or change their marketing.

Why?

- They were already offering virtual meetings via phone calls & screen-shares.

- Their clients had relationships with the advisor (and did not have to meet in-person).

- We were assisting them 100% virtually/remotely. So EVOLVD had the systems to support them. 🙌

Aside from this being a way to give yourself new business opportunities, Reviews are a great way to reconnect with your financial clients, provide them value & keep them loyal!

Win. Win. Win!

Email Marketing

“Email continues to be the main driver of customer retention and acquisition for small and midsize businesses. According to the data, 81% of SMBs still rely on email as their primary customer acquisition channel, and 80% for retention.” ~Source

As a Financial Advisor and business owner, you should always be maximizing your Marketing dollar. Especially during a ‘recession’.

Email marketing is an effective way to do this.

Just because leads did convert today, does not mean they should be dismissed.

Have longterm follow up in place.

We have seen advisors gain business from their email marketing like Snappy Kraken or Constant Contact.

We also know the majority of solo advisors are not streamlining their follow-up or even doing it.

Again, email marketing works to achieve this and is very cost-effective (when done right).

In times where consumers are cutting costs, it’s always the business that finds every opportunity to serve people, which increases their revenue & thrives.

Get creative.

Use what you have and maximize your resources.

Our advisor clients implementing the above strategies, are not only surpassing last year revenues, they are also simultaneously servicing their book of business.

Don’t let fearmongering stop you from thriving.

It can be done & it doesn’t have to be expensive.

It just has to be executed!

If you don’t have systems, or want help implementing ways to ‘Recession Proof’ your Financial Svc business, reach out to us.

Happy to discuss!